Economics_RS Class 10

A BRIEF OVERVIEW OF THE PREVIOUS CLASS (05:00 PM)

QUALITATIVE TOOLS (05:01 PM)

- CREDIT AUTHORISATION SCHEME [Not in existence]

- It was introduced in 1965 by RBI as selective credit control.

- Under this, commercial banks were asked to obtain prior approval of the RBI for giving any fresh credit of Rupees 1 crore or more to any single party. The scheme was discontinued in 1982.

- The idea behind the scheme was to watch the flow of credit to the borrowers closely and also ensure that commercial banks are lending according to RBI's guidelines. Even now RBI monitors certain bank credits above 5 crores to any single party.

- RATIONING OF CREDIT (05:07 PM)

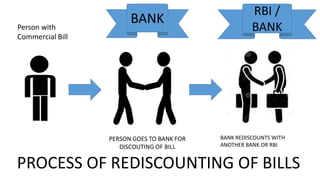

- Discounting and Re-discounting the Bills

- RBI can stop the re-discounting of the Bills, RBI is demotivating the banks by imposing an upper limit.

- Suppose, An Exporter decided to export goods worth 1 lakh on credit. The importer will pay back the amount after 90 days. The exporter while exporting the goods will issue a Bill duly signed by the customs officer.

- If the importer is not paying then the Bank guarantees to pay the amount. After the 45th-day exporter suddenly wants money and he will bring this Bill for the discount. [* The commercial bank has accepted this so this is called a commercial Bill]. SBI discounted the Bill at 10%.

- [* More the discounting, the more will the tranascation]

- Banks can again bring this Bill to RBI for Re-discounting.

-

- Credit is rationed by limiting the amount available for each commercial bank. RBI also controls the Re-discounting of Bills. This mechanism also helps in lowering credit exposure to risky sectors.

- MORAL SUASION (05:19 PM)

- It is the pressure exerted by RBI on the Indian banking system.

- It is the suggestion given to banks that helps in restraining credit during an inflationary period.

- DIRECT ACTION

- Under this method, RBI can impose restrictions on a bank if they are not adhering to RBI directives.

- Central banks can levy penal rates and at times go to the extent of cancellation of licenses.

CHALLENGES OF MONETARY POLICY IN THE LONG TERM (05:25 PM)

- Monetary policy is acting as a tool to boost temporary demand rather than to promote long-term sustainable economic growth

- For the long term, the requirement is

- a) Fiscal policy- Tax concessions, efficient tax policies, Efficiency with respect to logistics

- b) Handle the challenges with respect to unemployment

- c) Playing at grassroots levels- labour law reforms, job creation

- d) Strong market fundamentals- Doing business index.

- e) Current account deficit, Fiscal deficit, etc if are good, then the business environment is good.

- f) Pro-business policies of the government.

- g) Monetary transmission should be effective.

- Conclusion- close coordination between fiscal policy and monetary policy

INVESTMENT MODELS AND PLANNING (05:34 PM)

INVESTMENT MODELS- (FOR MAINS)

- The framework of the topic

- What is an investment?

- Investment-led growth v/s consumption-led growth

- Why China wanted to shift from investment-led growth to consumption-led growth

- Why India wants to shift from consumption-led growth to investment-led growth.

- Circular flow of Income

- Different types of Models- Harrod Domar model, Lewis model, Nehru-Mahalnobis model

- Why five-year plans and objectives of planning [Long-term objective of planning]

- Different types of plans and different 5-year plans. [* Up to 12th five year plan]

- Replacement of Planning Commission with NITI Aayog.

- Critically analyzing the planning.

WHAT IS INVESTMENT? (05:40 PM)

- The investment will always lead to capital formation.

- Capital formation is the accumulation of capital goods in a country.

- After production-

- It can be either consumed by domestic consumers or

- It can be consumed by the private sector or

- It can be consumed by the government or

- It can be consumed by the external sector.

- During COVID

- Consumers were focusing on savings and also facing unemployment.

- The private sector was not consuming as the market fundamentals were not sound and credit was not available.

- Government hands are tied as it has to spend on welfare measures and the Government Fiscal deficit was widened.

- COVID is an international scenario and countries are protecting their domestic market.

- Circular flow of income- Two-sector theory (05:49 PM)

- When there are two sectors i.e. Households and Firms.

- Assumption

- a) Completely closed economy

- b) No Banks, No government, and No taxes imposed

- c) No savings done by the households.

-

- Consumption expenditure= Factor payments= Money is moving

- Goods and services= Factor services= Movement of goods

- Modification in the two-sector model

- When the new entity is involved i.e Bank. The household is saving some proportion and keeping in the banks [Fall in consumption goods]

- The bank is giving a loan to the private player and the private player is using this money to purchase more capital goods i.e. Machines or a new firm or capital goods are increasing (Investment) [Rise in capital goods]

- The machines are used to do more production [capacity creation]

- This increased production is exported [Export-led growth model]

- More savings will lead to more investment and more investment will increase the capacity of the products so there will be the only option to export. This is investment-led growth. For this investment-led growth, exports became very important.

- Both investment and export go together.

- Aggregate demand= C (domestic consumption)+ G (Government consumption)+ I (Investment)+ X(export)

- GDP= (C- CI)+ (G-GI)+ (I-II)+ X

- GDP= C+ G+I+X -(CI+ GI+II)

- GDP= C+ G+ I+ X-M

- (CI+ GI+II)= Imported items= M

- For China- 45% was consumption goods and 55% was capital goods

- For India= 29% was capital goods and 71% were consumption goods

- In India, savings are done by households, and these savings were converted to investments. The gap between Investments and Savings in India is less.

- In the 1960s China opened its market to foreign investors and it attracted many investors.

- Important points (06:20 PM)

- Investment is that part of the total output that comprises physical capital goods. Investment is nothing but gross capital formation i.e. accumulation of capital stock of the nation.

- For example- if the total output of a country is Rs 1000 and the proportion of consumption goods is 800 and capital goods is rs 200, then the gross investment is equal to 200/ 1000= 20%.

- In the above case, if the factory loses Rs 100, due to consumption of fixed capital (Depreciation) then the net investment is equal to Gross investment minus Depreciation i.e 200-100= 100 or 10%.

- The term investment is different for economists and the rest of the world. Purchase of assets like stocks, Mutual funds, and insurance products are not investments for economists as they do not add to the net wealth of the nation rather they reflect a credit relationship between two parties.

- The financial asset of one party in the economy could be offset by the financial liability of the Other party. Thus when we aggregate the wealth of all the members of the economy. These assets and liabilities cancel and there is no creation of new assets.

- The government's $ 5 trillion economy was based on an investment-led growth model which is also called as Shanghai or Chinese model which mainly focuses on the increase in private investment as a main driving factor for capital formation and subsequently economic growth.

- Nominal GDP (06:49 PM)

- It is nothing but the total output of the country at the current year's prices (Quantity of 2024-25 * Price of 2024-25= $5 tn is nothing but the nominal GDP of 2024-25).

- Nominal GDP can increase because of an increase in Q or P or Q&P

- Real GDP

- Real GDP is the GDP calculated at the base year or reference year prices (Constant prices)

- Real GDP indicates an increase in growth due to production.

QUESTION (07:13 PM)

- Question- Savings is one of the important factors for economic growth. What are the challenges of a savings-led investment growth model and what are the other factors other than savings which can boost the economic growth of the country? (10 marks/ 150 words).

- Approach:-

- Challenges of savings-led economic growth

- a) More inflation will lead to fewer savings.

- b) Savings will be okay only when financial inclusion is proper.

- c) Challenges of monetary transmission.

- d) Unemployment and low incomes.

- e) More of the informal economy.

- f) Market dynamics

- Other than Savings

- a) FDI and FII

- b) External commercial borrowings

- c) Stock markets and bond markets

- d) Fiscal policy, Taxation policy

- e) Infrastructure.

- From Income, savings was created and these savings were given as investment and this investment will be used to buy machines (capital goods). How this will lead to more job creation?

- This investment is the result of the Income. So we need to work on labour productivity.

- a) Cutthroat technology- Creative destruction (Disruptive technologies)- Technology will first replace labour but in the longer term, it will create more jobs.

- b) For creating jobs one has to become efficient. Across the supply chain when one is efficient then more jobs will be created.

- c) More factories/ expansion by private players will create new jobs.

- d) Creative destruction can not happen without R&D. So more investment in R&D will create more jobs.

- Question- Governments target of a $5tn economy is possible through an investment-led growth model. Critically analyze the feasibility of an investment-led growth model. (10 marks/ 150 words).

- Challenge of feasibility.

- Investment-led growth model will be successful only when there is an export.

- In exports, there is cut-throat competition from China. [* Raghuram Rajan said- "We are trying to become China at the wrong time"].

- [** Poor person spends more of their income on basic goods. When a country is moving from developing to developed consumption decreases. So we need to think about the exports only. We need to widen our markets and become efficient & competitive ]

- In the era of AI, the assembling jobs will be replaced. [* call centre jobs, Diagnostic services ]. So government must focus on manufacturing.

INVESTMENT-LED GROWTH (07:39 PM)

- It depends on investment to create new capacity [* Capacity creation] leading to more employment along with increasing production capacity.

- In investment-led growth, supply rises in tandem with demand leading to increased economic growth.

- Chinese experience of investment-led growth

- [* Investment-led growth will lead to an increase in jobs; increase in investment i.e. FDI, FII; an increase in capacity creation; India can reach the $5tn target; it will also help in rupee value stability; it will try to maximize the growth]

- [* By 2030-2040, the biggest challenge India will face will be job creation]

- Chinese introduction of capitalist market principles led to mass privatization and the opening up of their markets to private investments.

- Due to the availability of cheap labour, foreign firms started building factories in China to take advantage of cheap labour.

- Chinese development strategy increased their focus on larger cities like Shanghai and Beijing.

- The investment Led growth model in China increased production but did not increase the consumption base proportionately i.e. lack of inclusiveness.[* People's per capita income did not increase.]

- China was successful in increasing GDP growth but failed to increase household income growth

- India's growth model was different from the Investment export-oriented strategy of China-

- 1) China has derived the predominant part of its growth from external sources both in terms of foreign investment and export markets. India's growth is from internal sources i.e. India's net export to GDP ratio has been significantly lower than that of China.

- 2) India in spite of having a large trade deficit yet has managed to grow at reasonably high rates.

- 3) Domestic savings-to-investment gap in India has been kept at low levels and India has managed to finance a predominant part of its capital formation from domestic savings.

The Topic for the next class:- Why China wanted to shift from investment-led growth to consumption-led growth and Why India wants to shift from consumption-led growth to investment-led growth.